A couple of common questions we get during election years are:

“What do you think the markets will do if <Candidate X> is voted in?”

Or:

“How are you positioning the portfolio, because if <Candidate Y> is elected, I’m convinced the economy will struggle?”

We’ve even had this occasional request:

“Move my portfolio to all cash, because if <Candidate Z> is elected, I don’t want to lose money when the market crashes.”

We spent the better part of the years between 2008 and 2016 (when Obama was president) convincing Republicans that it was okay to invest and that the world wasn’t going to implode. We’ve spent the better part of the past four years doing the exact same thing with Democrats.

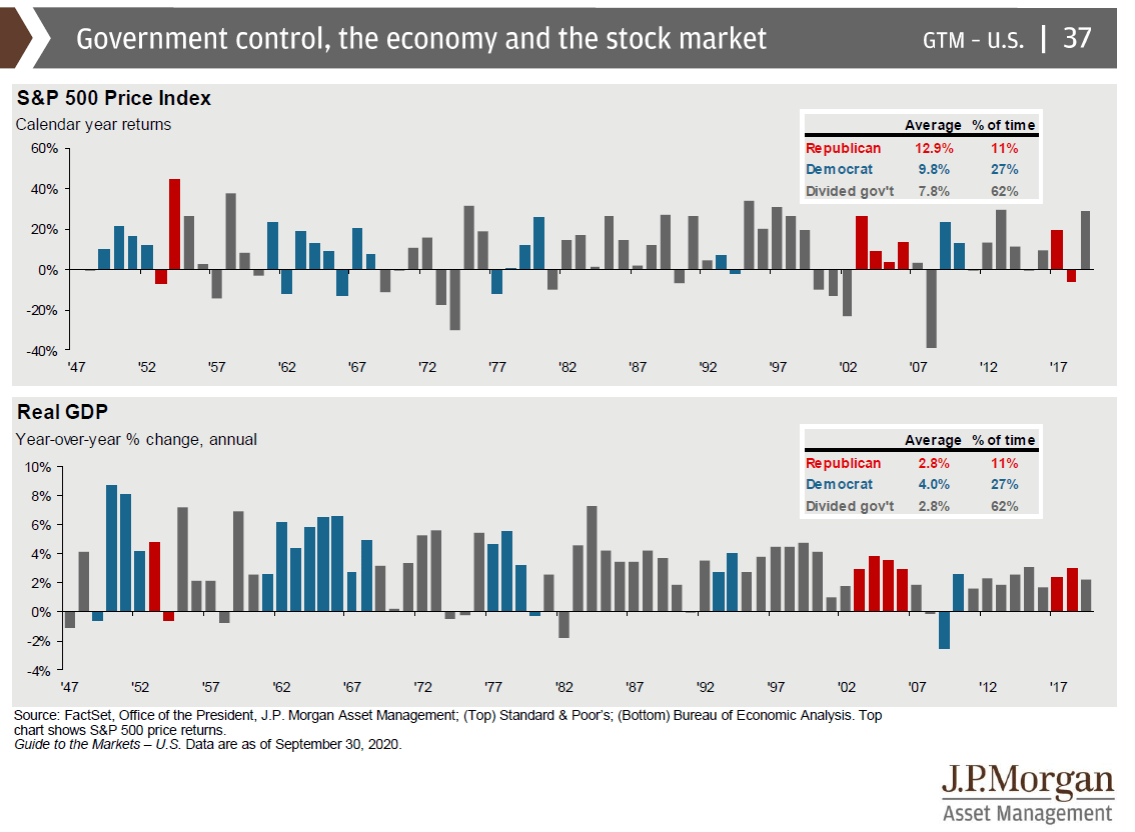

Since WWII, the House, Senate and White House have been controlled by Republicans 11% of the time, and controlled by Democrats 27% of the time. The other 62% of the time, the three bodies have been split. In all three scenarios, the economy has historically grown, and the stock market (S&P 500) has risen at least 7.8% on average. The historical lesson here is that separating your political leanings from your investing strategy is critical; we can’t afford to allow our political positions to impact our financial health and planning outcomes.

Although policies can and do have an impact on the economy and on markets, the stability of the economy and markets is critical to both parties. Regardless of party and politics, market and economic stability will always be a core tenet. We also live in a global world: More than 50% of the S&P 500’s revenue comes from outside our borders. What happens in the U.S. plays a major role in the global economy, but it certainly doesn’t drive the entire global economy.

Sticking to a prudent, long-term plan is critical to long term success. Missing a few key years of growth can be disastrous to your long-term financial planning outcomes.

Here are a few more items you should consider in regard to your portfolio management:

Learn more about your risk tolerance and how it influences your investment policy; understand the top four wise principles of portfolio management; and find out why your financial plan is not the same as your portfolio.