Luck, Retirement & Risk: Understanding Sequence of Return Risk

For all your careful, methodical retirement planning, how long your money will actually last during your later years has much to do with luck and timing. Retire in a bull market, and your investment portfolio may grow enough that you can sustain a later downturn. On the other hand, retire during a bear market, and your investment accounts may not last as long as you had hoped.

This dilemma is referred to as sequence of return risk (also known as sequence risk). Jared Hirte is a portfolio manager with Ironwood Wealth Management. We asked him to help us better understand what sequence of return risk means for you, and what steps you can take to protect yourself and your retirement funds.

What exactly is the sequence of return risk?

This risk is essentially the risk of bad returns early in retirement. Portfolio performance in the early years of retirement has a disproportionate amount of importance to your entire investing career. Here’s why: In the early years of retirement, if you’re forced to withdraw money during a market correction, those dollars never have the opportunity to recover, and it can have a lasting impact on the remainder of your retirement.

If you have a beginning portfolio value of $1 million, and you withdraw forty thousand dollars, and then the market drops by 20%, your portfolio is now worth $768,000 ($960k * 80%). You would need an investment gain of about 30.2% to get back up to that $1,000,000 where you would have started.

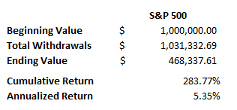

Here’s an example showing what could have happened to a hypothetical investor’s portfolio if that investor decided to retire at the end of 1999, pulling $40k (with an annual 2% inflation adjustment each year), and 100% of their portfolio was invested in the S&P 500.

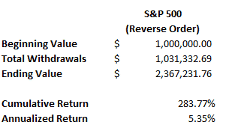

If we simply reverse the order of these returns, so that the drastic 37% decline from 2000-2002 was received at the end of retirement rather than the beginning, you get a dramatically different story.

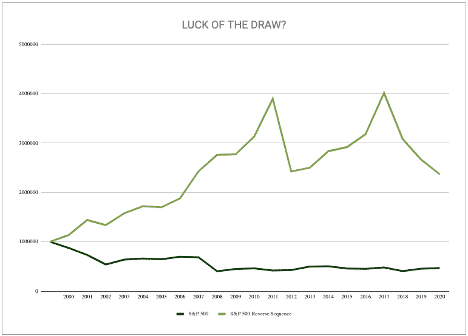

The chart below shows the comparison of these retirement outcomes:

The decision to retire in 1999 would have been a personal one, and not something you can describe as good or bad (without the benefit of hindsight). But what the figures and this graph show is that from a market perspective, the retiree would’ve been in trouble, because stocks fell 37% from 2000 to 2002, on top of annual withdrawals.

On the other hand, if in our hypothetical example, the bear market instead occurred at the end of the period, rather than at the beginning, the ending value would have been more than quadruple.

Even though the withdrawals, cumulative, and annualized return metrics are identical under both scenarios, you end up with far different ending values. Some of that is luck, but with the proper risk mitigation strategies in place, luck plays less of a role. Without risk mitigation strategies, the probability that you can really get burned drastically increases.

What should an investor do about the sequence of return risk?

Understand that investing comes with an inherent level of market risk, and your asset allocation will predominantly dictate the level of market risk you are taking at any given time. Depending on your individual circumstances, your financial plan will have varying levels of durability to withstand market risk.

Work with a wealth advisor to help you understand your financial plan and determine appropriate levels of market risk, as you move toward and through retirement. Your financial plan will help determine what rate of return is necessary (this is known as the “hurdle rate”) to fulfill all your goals and objectives. Once the hurdle rate is calculated, a wealth advisor can begin the process of selecting an appropriate level of market risk that may be needed to achieve the hurdle rate.

Very rarely is it about swinging for the fences in order to try and earn the highest return possible. In order to lower our sequence of return risk, it may make sense to lower the overall market risk of the portfolio. When you lower the market risk of the portfolio, you will lower the expected return of that portfolio (in most cases), but you will also lower the volatility of that portfolio. In fact, in many cases, you can improve your financial planning outcomes (not run out of money) by reducing your market risk and earning a lower, but more consistent return.

How exactly can a wealth advisor help to manage this risk?

For starters, they can help you determine your ability to take risk (dictated by the financial plan) as well as your willingness to take risk (determined by conversations, risk tolerance questionnaires, historical behavior, etc.). Your willingness to take risk starts the conversation. Take more risk than you are willing to and during a bear market you may end up hitting a point where you make irreversible decisions because the pain of your loss is too great. However, if your willingness to take risk is too low, you may not be able to expect a high enough return from the portfolio to achieve all your objectives and goals. A wealth advisor can help you understand these tradeoffs and their impact to your financial plan.

A wealth advisor will also run what are called Monte Carlo simulations as part of your financial plan. These include 1,000 different possible outcomes, each with different sequence of returns, based on your asset allocation. These 1,000 trials will include scenarios where the investor would have been “lucky,” as well as scenarios where the investor would have been “unlucky.” If enough of the trials show that our portfolio will last as long as our retirement (we like to see 85% or higher), then we have confidence that we won’t need to change our financial plan no matter what our “luck” is.

A wealth advisor, with the help of their portfolio team, will also put other risk mitigation strategies into play, including diversification and portfolio rebalancing.

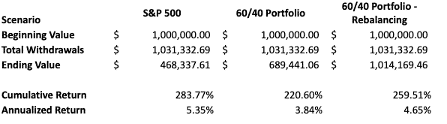

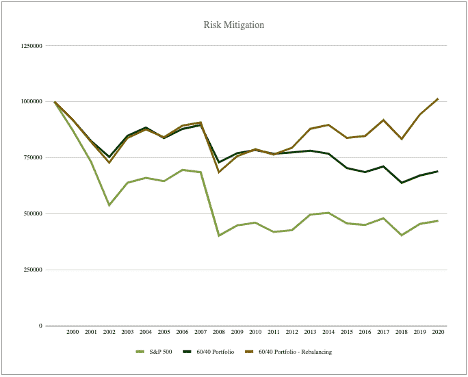

If we take the same example from above, you can see three different scenarios with vastly different outcomes based on the risk mitigation strategy involved. In the first scenario, the portfolio is made up of all stock (same as above).

In the second scenario, we have done a simple diversification strategy of 60% stocks, 40% bonds. Here, the investor would end up with a higher portfolio value, although returns are actually lower from a percentage perspective. Still, the investor who diversifies would end up in a much better position.

The final scenario adds in the layer of rebalancing. This is where working with a wealth management firm like Ironwood can really benefit retirees, because it is not typically something an average investor can do to the same level. Rebalancing involves selectively selling assets that performed well and buying up assets that performed poorly as a way to decrease risk and improve expected returns.

The Bottom Line

When saving for retirement, you can sometimes save your way out of mistakes over time. When you start drawing from your retirement, mistakes are magnified. Sequence of return risk may be a matter of luck, but there are ways to avoid mistakes and mitigate risk, and we’re here to help. Set up an appointment with a wealth advisor to get started today.